lake county real estate taxes illinois

Lake County IL 18 N County Street Waukegan IL 60085 Phone. The Lake County Property Records and Licensing Office make every effort to maintain the most accurate information possible.

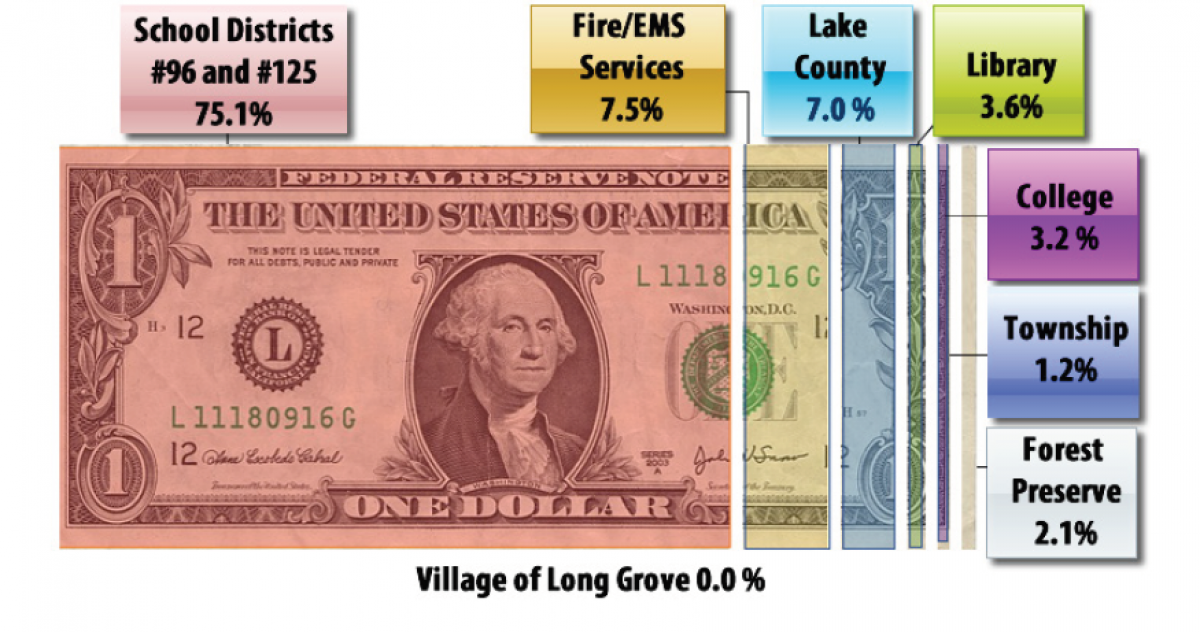

Taxes Fees Long Grove Illinois

Site Appearance Format Images.

. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Tax amount varies by county. Tax amount varies by county.

Lake County collects on average 219 of a propertys assessed fair. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. The median property tax also known as real estate tax in Lake County is 628500 per year based on a median home value of 28730000 and a median effective property tax rate of.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To view Lake Countys property tax rate and other major revenue sources view our annual budget. No warranties expressed or implied are.

The Lake County Property Records and Licensing Office make every effort to maintain the most accurate information possible. 173 of home value. After clicking the button the status will be displayed below.

For comparison the median home value in Lake County is. Lake County IL Property Tax Information. 173 of home value.

No warranties expressed or implied are. At Lake County Appeal we possess the knowledge capital to win even the most challenging appeals. Property Tax Change-of-Name Form Enter the 10 digit Property Index Number PIN with or without dashes for the property.

Illinois TaxesIncome Tax Sales Tax Property Tax Corporate Tax Excise TaxesLake County Property Tax Rate 2022Go To Different County Lowest Property Tax. Select Home Page Menu Image. Lake County collects on average 219 of a propertys assessed fair.

Lake County Appeal has. The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300.

Our team knows Lake County and Chicagoland as a whole.

Property Taxes Lake County Tax Collector

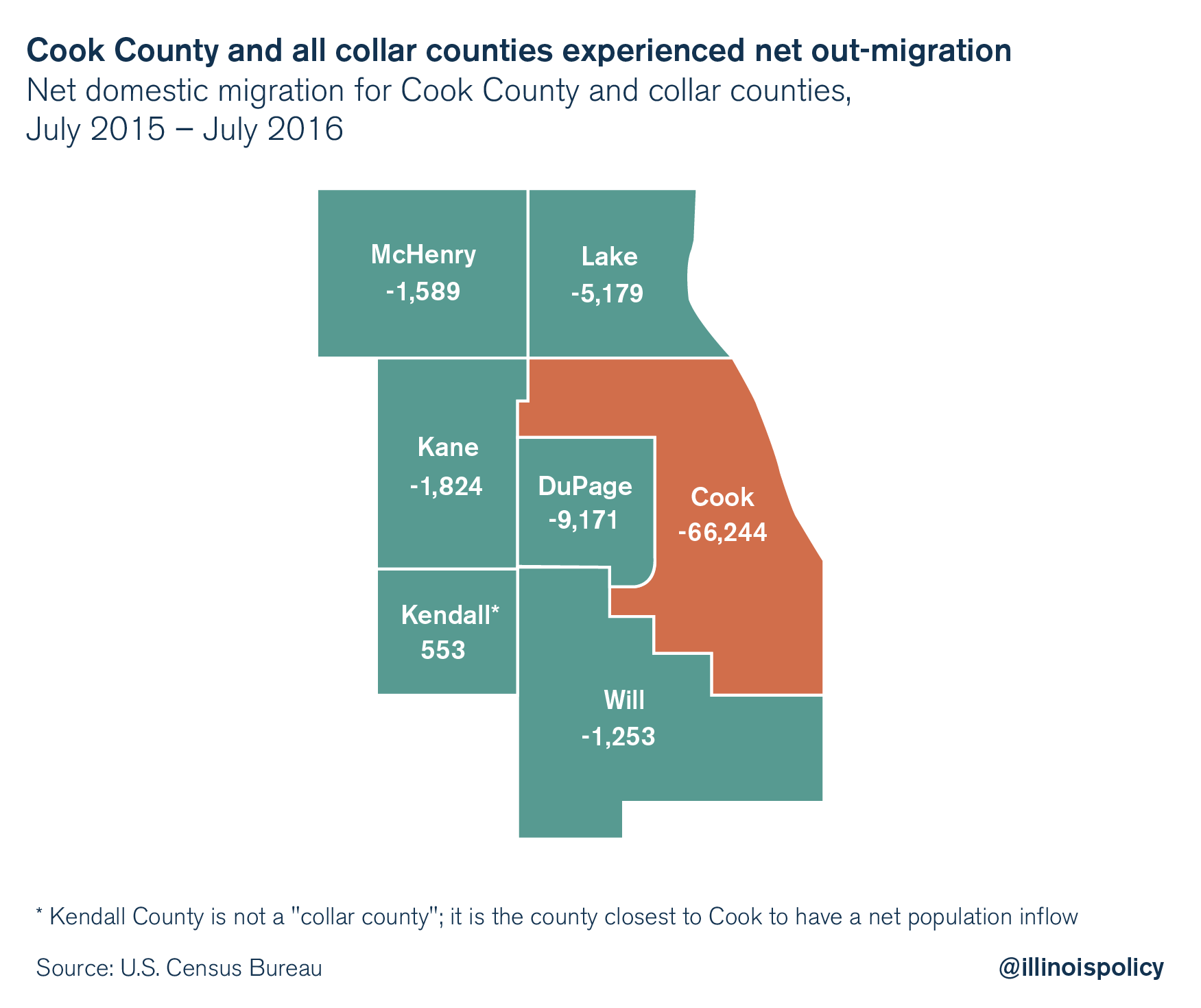

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

Oaks Of The Hollow Fox Lake Real Estate Homes For Sale In Oaks Of The Hollow Fox Lake Il Movoto

24 Homes For Sale In Ingleside Il Propertyshark

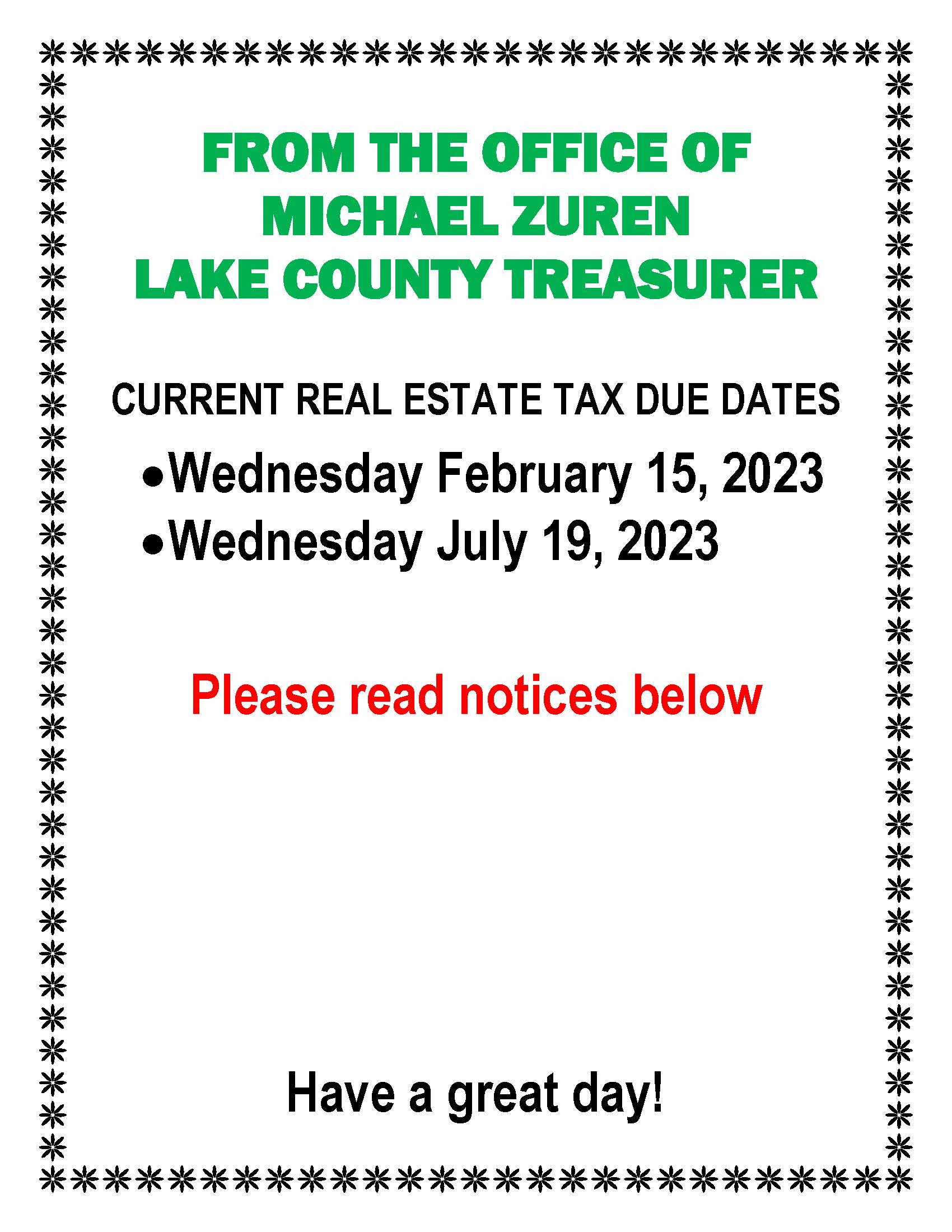

Property Tax Due Dates Treasurer

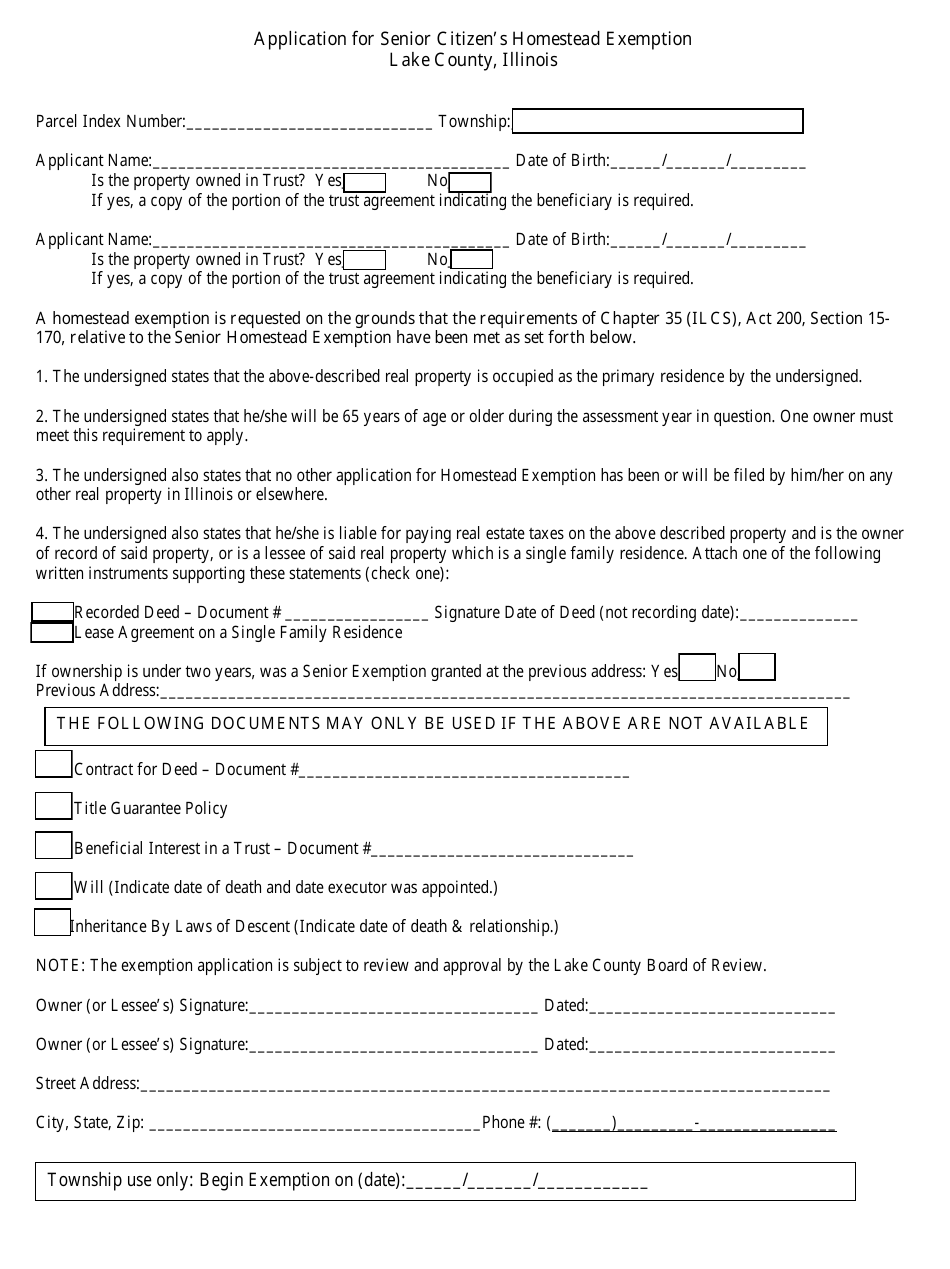

Lake County Illinois Application For Senior Citizen S Homestead Exemption Download Fillable Pdf Templateroller

Appraisal Hazel Crest Il 60429 Water Tower Chicago Illinois Chicago Suburbs

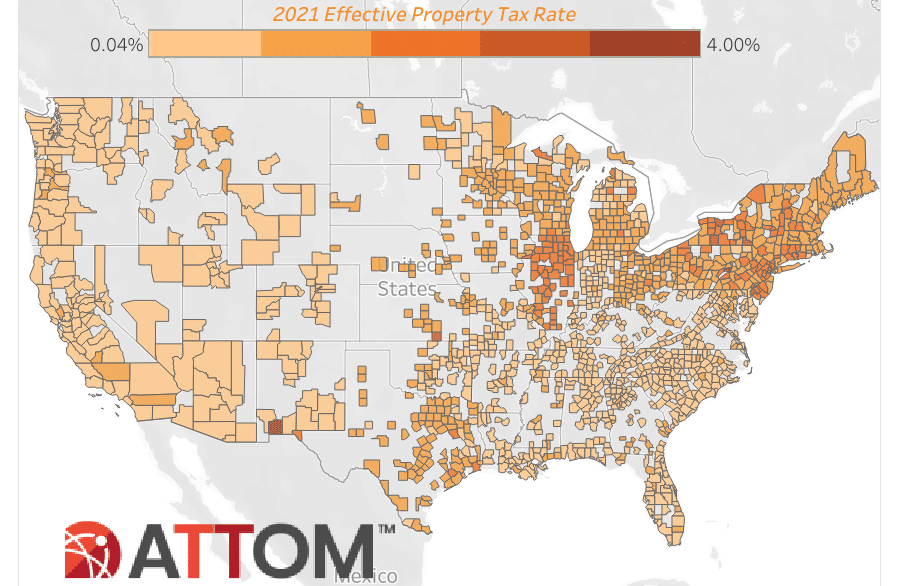

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

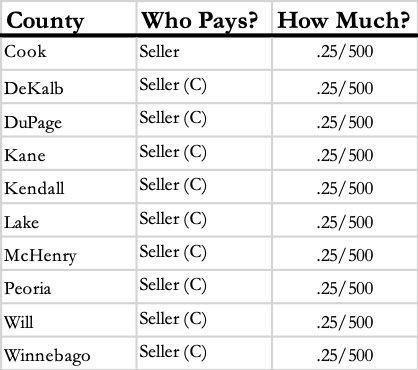

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Dupage And Lake County Tax Bills Starting To Arrive Chicago Real Estate Closing Blog

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

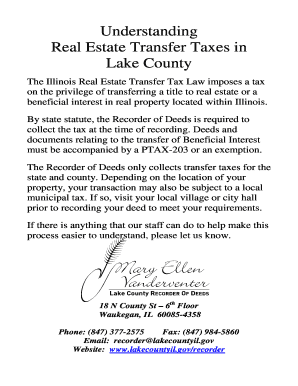

Fillable Online Lakecountyil Understanding Real Estate Transfer Taxes In Lake County Understanding Real Estate Transfer Taxes In Lake County Fax Email Print Pdffiller

Analysis Lake Forest Pays Property Taxes 1 5 Times National Average Lake County Gazette

84 06 Acres Libertyville Il Property Id 11183877 Land And Farm

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy